4% Risk

Reasons for entry:

- Resistance to the down trend appears to be forming with the RSI showing slight divergence

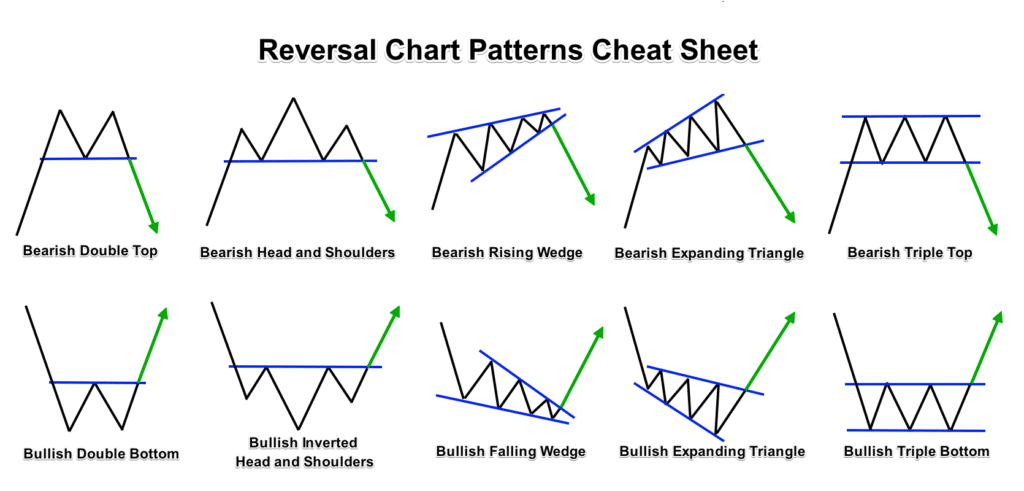

- Price appears to be bouncing off a support line, forming a sort of double bottom and unable to break the previous day’s low

Overall sentiment

I feel that there will be a slight bullish movement, maybe not enough for a complete trend reversal but strong enough to maybe get some pips, in the few days before this I wouldn’t have bought since there was a strong downtrend however there seems to some resistance now to be open to both ways

Confidence level at start of trade: 7.2

Confidence level during trade: 7

**POST TRADE COMPLETION**

Result: Stop Loss hit

What went wrong?

- Downtrend was already happening, ignored heiken ashi strong trend and clear downtrend indicator

- Reversal signals weren’t strong enough, there really wasn’t a reversal signal at all apart from a minor fibo support line (not an actual drawn one), a very slight RSI divergence and some minor price action signs of reversal. The reversal might be showing fruition but is also too early.

- More volume than expected which suddenly pushed the price down not even hours after opening, news appears clear overall. Time was close to NY close.

What could have been improved

- Having the confidence to actually place a limit order slightly below the support line instead of going in to an immediate entry order which was above the support line because I thought the price might not go down enough bounce. Place a limit order slightly below the supposed support line or new high/low and stick to it. As a result of ignoring this the price reached close to the stop loss.

- Follow the trend if it makes sense, stick to placing limit orders, e.g a sell limit at a resistance line instead of trying to anticipate a reversal

- Widening SL+TP for a trend, the SL was about 23 pips with a TP of 46, so far it seems that most of the winning trades can stretch out for more TP and a wider SL especially during a trend. It also helps to place limit order a little above/below the support/resistance line AND have the TP a little beyond the target s/r line (essentially anticipating possible wide moves).

- Fibo lines can be distracting, though they are needed and work with the trend quite well but they can create a bit of a mess, perhaps have a seperate fibo chart or lessen their visbility while keeping prominence to support lines (and their relative strength i.e a strong s/r line could be bolder)

- Ignore what the market thinks, i.e ignore sentiment on myfxbook just stick to the system.

- Listen to the 1D chart as well and refer to the checklist

- Make more of a checklist

Possible checklist ideas:

- If there’s a trend then try to base trades on direction i.e on a downtrend try to focus on sell limits

- For limit order conditions and reason to actually enter the trade refer to (example sell limit):

- Whether price is hitting the SMA 12 from underneath it (i.e price goes up and hits the SMA 12)

- Possible resistance lines

Constructing a chart:

- Refer to course checklist but also, when constructing s/r lines, more recent ones are more reliable and should be used as the anchor point