Rule and guideline ideas

- Make sure one-click trading is turned OFF. (Tools > Options > Trade). This is to prevent any accidental one click trades

- The larger the consolidation, the larger the breakout (ref)

- The fourth decimal in most currency pairs is a pip, for most Japanese pairs the second decimal is a pip. On Oanda they use an extra decimal (pipette) and the middle-click number’s last digit should be considered a decimal. E.g if the middle-click line shows ‘222’ this would typically mean 22.2 pips.

- Use MyFxBook to track your stats and also to check the news

- To calculate the spread click the down arrow on a price chart at the top left and compare the bigger numbers. Video explainer here

- The most important news types can be found here generally unemployment rates, Nonfarm payrolls and interest rates are considered very important

- Look for RSI divergences, a regular divergence signals a trend reversal while a hidden divergence signals trend continuation. Useful links:

Video

Cheat sheet

- Trend continuation can be confirmed when price penetrated and goes beyond the previous peak/trough

- Uptrends tend to be smooth and long whereas downtrends tend to be sharp and short

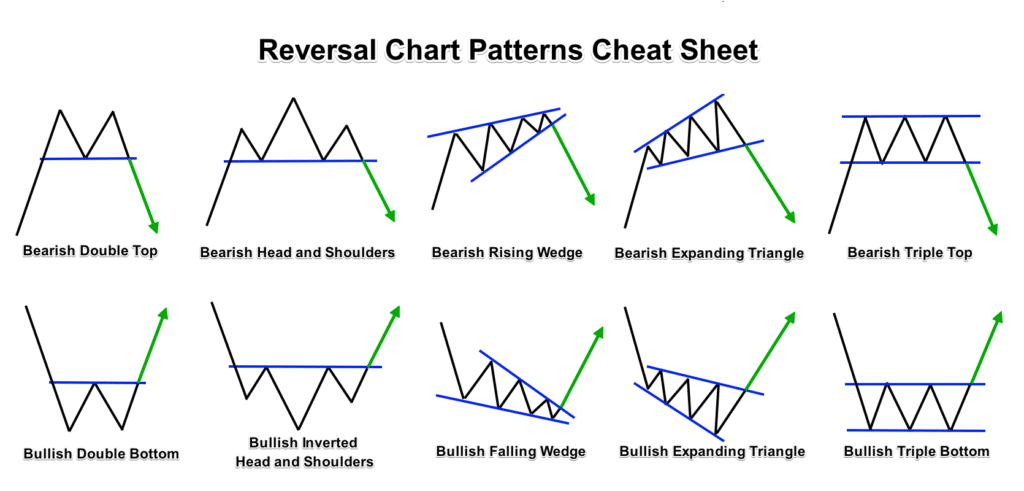

- TRADE REVERSALS ideally trade a reversal at the end of a trend

Chart Patterns:

Keep in mind some of the most common patterns:

- Head and shoulders

- Double top/bottom

- Triangles (neutral)

Good links to quickly update yourself:

https://www.udemy.com/replaceyourjob

https://www.currencycaptain.com

Basic chart plotting (v helpful):

https://www.udemy.com/replaceyourjob/learn/v4/t/lecture/7706302?start=0