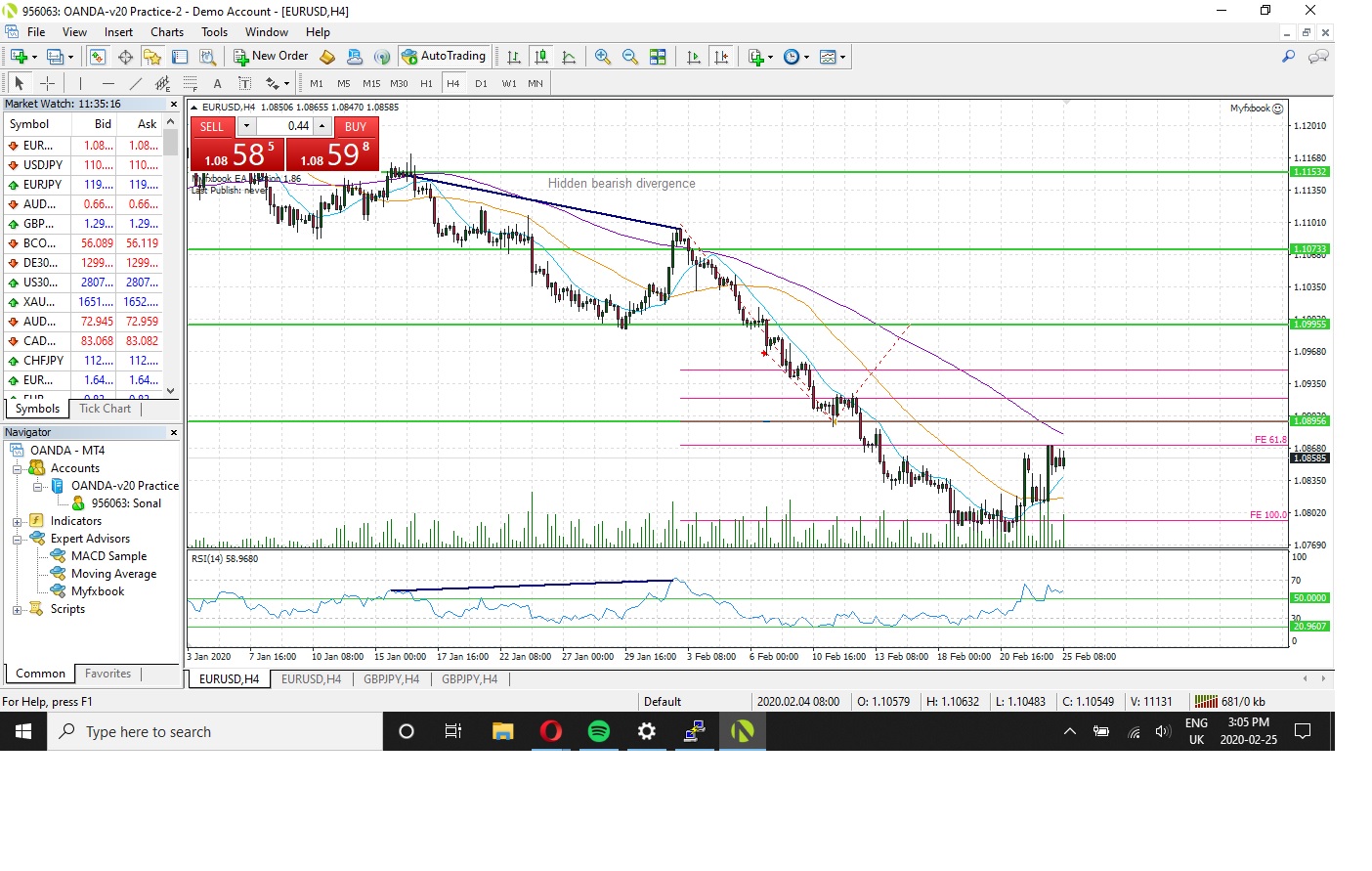

Sell Stop EURUSD 5th Feb

4.5% Risk

Reasons for entry:

- Price could break through and continue the 4hr down trned

- Hidden divergence showing bearish strength

Reasons to not enter:

- Day trend is still up/consolidation

- Price could actually be forming a reversal double bottom

Overall sentiment

It seems like the price is going down, I’ve placed a sell stop a little bit below the support line, that way if price does break through it’ll trigger a trade but if the price reverses instead it’ll leave it alone without triggering a trade.

Confidence level at start of trade: 7.5

Confidence level during trade:

**POST TRADE COMPLETION**

Result: Take profit hit

What went right?

- RSI DIVERGENCE – Followed the hidden bearish divergence and trusted it

- Entered trade below an S/R line so that the trade would only start if the price broke through

What could have been improved?

- The T/P could have been longer, the S/L was a bit too tight

Analysis – EUR/USD – 5th Feb 2020

News report

thing

** Rulebook **

Rule and guideline ideas

- Make sure one-click trading is turned OFF. (Tools > Options > Trade). This is to prevent any accidental one click trades

- The larger the consolidation, the larger the breakout (ref)

- The fourth decimal in most currency pairs is a pip, for most Japanese pairs the second decimal is a pip. On Oanda they use an extra decimal (pipette) and the middle-click number’s last digit should be considered a decimal. E.g if the middle-click line shows ‘222’ this would typically mean 22.2 pips.

- Use MyFxBook to track your stats and also to check the news

- To calculate the spread click the down arrow on a price chart at the top left and compare the bigger numbers. Video explainer here

- The most important news types can be found here generally unemployment rates, Nonfarm payrolls and interest rates are considered very important

- Look for RSI divergences, a regular divergence signals a trend reversal while a hidden divergence signals trend continuation. Useful links:

Video

Cheat sheet

- Trend continuation can be confirmed when price penetrated and goes beyond the previous peak/trough

- Uptrends tend to be smooth and long whereas downtrends tend to be sharp and short

- TRADE REVERSALS ideally trade a reversal at the end of a trend

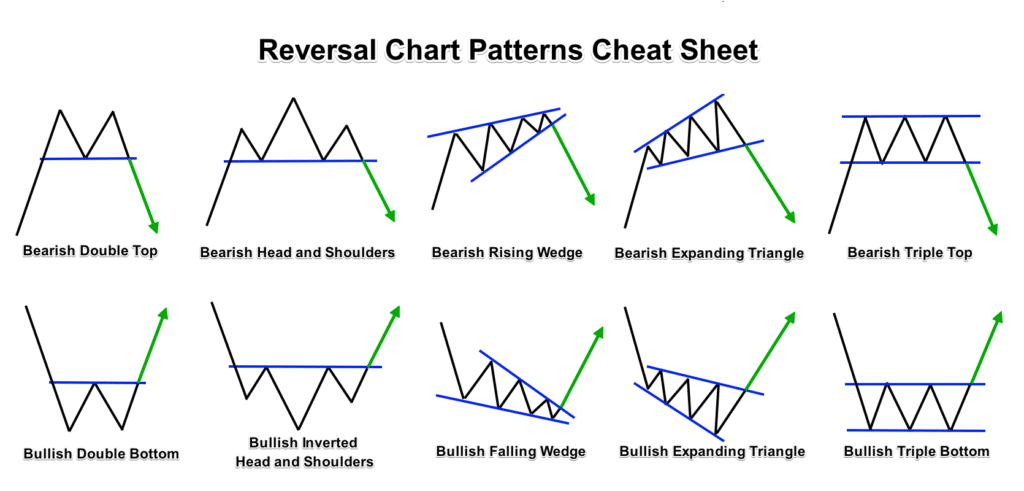

Chart Patterns:

Keep in mind some of the most common patterns:

- Head and shoulders

- Double top/bottom

- Triangles (neutral)

Good links to quickly update yourself:

https://www.udemy.com/replaceyourjob

https://www.currencycaptain.com

Basic chart plotting (v helpful):

https://www.udemy.com/replaceyourjob/learn/v4/t/lecture/7706302?start=0

EUR/USD 9th Oct Analysis

test

EUR/USD – Sell Limit 3rd/4th Oct

5% Risk

Reasons for entry:

- SELL limit because of the downtrend, higher confidence because trading in trend direction is more desirable.

- Using a combination of support lines, fibo lines AND the number of pips difference in the last swing low to swing high (about 88 pips) I made a calculated guess at the resistance level

- Price looked like it was hitting support and bouncing up a little, with this in mind I figured a sell limit ahead of time near a possible resistance might be a viable entry point

Reasons to not enter:

- RSI is still showing divergence (higher lows despite price making lower lows), taking this to account the TP is simply the low of the previous day and does not exceed it thereby appearing to play it safe while still in a downtrend

Overall sentiment

Overall since its a downtrend it made sense to stick to doing sell orders. The downtrend looks like its slowing down but this isn’t enough to have confident buy orders. I feel that at the very least some sort of double bottom to the downtrend will form which will reap profits even if the trend is slowing down

Confidence level at start of trade: 8

Confidence level during trade: 8.5

**POST TRADE COMPLETION**

Result: Take profit hit

What went right?

- Trading with the trend

- Waited it out, patience is key, the trade took almost 2 trading days but because of the weekend had been active for a few days

- Very accurate entry point, the combo of resistance lines, fibo lines and comparing pip difference of the last swing high to low gave a very nice and low risk entry point

- Wider SL and TP point as a result of the above point

What could have been improved?

- Got a little impatient and lowered the TP slightly because it had almost hit it before but was retracting, lowered only by about 2 pips though, however I could have been even more patient

EUR/USD – BUY 3rd October

4% Risk

Reasons for entry:

- Resistance to the down trend appears to be forming with the RSI showing slight divergence

- Price appears to be bouncing off a support line, forming a sort of double bottom and unable to break the previous day’s low

Overall sentiment

I feel that there will be a slight bullish movement, maybe not enough for a complete trend reversal but strong enough to maybe get some pips, in the few days before this I wouldn’t have bought since there was a strong downtrend however there seems to some resistance now to be open to both ways

Confidence level at start of trade: 7.2

Confidence level during trade: 7

**POST TRADE COMPLETION**

Result: Stop Loss hit

What went wrong?

- Downtrend was already happening, ignored heiken ashi strong trend and clear downtrend indicator

- Reversal signals weren’t strong enough, there really wasn’t a reversal signal at all apart from a minor fibo support line (not an actual drawn one), a very slight RSI divergence and some minor price action signs of reversal. The reversal might be showing fruition but is also too early.

- More volume than expected which suddenly pushed the price down not even hours after opening, news appears clear overall. Time was close to NY close.

What could have been improved

- Having the confidence to actually place a limit order slightly below the support line instead of going in to an immediate entry order which was above the support line because I thought the price might not go down enough bounce. Place a limit order slightly below the supposed support line or new high/low and stick to it. As a result of ignoring this the price reached close to the stop loss.

- Follow the trend if it makes sense, stick to placing limit orders, e.g a sell limit at a resistance line instead of trying to anticipate a reversal

- Widening SL+TP for a trend, the SL was about 23 pips with a TP of 46, so far it seems that most of the winning trades can stretch out for more TP and a wider SL especially during a trend. It also helps to place limit order a little above/below the support/resistance line AND have the TP a little beyond the target s/r line (essentially anticipating possible wide moves).

- Fibo lines can be distracting, though they are needed and work with the trend quite well but they can create a bit of a mess, perhaps have a seperate fibo chart or lessen their visbility while keeping prominence to support lines (and their relative strength i.e a strong s/r line could be bolder)

- Ignore what the market thinks, i.e ignore sentiment on myfxbook just stick to the system.

- Listen to the 1D chart as well and refer to the checklist

- Make more of a checklist

Possible checklist ideas:

- If there’s a trend then try to base trades on direction i.e on a downtrend try to focus on sell limits

- For limit order conditions and reason to actually enter the trade refer to (example sell limit):

- Whether price is hitting the SMA 12 from underneath it (i.e price goes up and hits the SMA 12)

- Possible resistance lines

Constructing a chart:

- Refer to course checklist but also, when constructing s/r lines, more recent ones are more reliable and should be used as the anchor point

**Important info regarding journal**

What should this journal contain?

- Entries for every new trade, including a checklist and calculation beforehand

- General sentiment of the day if no trade happens

- Weekly sentiment which reflects on trades and what went right/wrong, what to improve on etc.

Breakdown of general entry structure:

- Screenshots, includes indicators

- General and meta details of the trade such as:

- The currency pair

- Entry price

- TP/SL and pips of them

- Whether its a Sell/Buy

- Trade time

- Reason for the trade entry

- What went right/wrong?

- How can I improve this trade?

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!